Australia’s housing market is gearing up for another major growth cycle, and Melbourne is positioned to be one of its biggest movers. New forecasts from Domain, supported by the major banks, show prices across every capital city climbing to fresh record highs by the end of 2026.

For local owners, investors, and future sellers, this sets the scene for a decisive window of opportunity.

Melbourne House Prices to Fully Recover and Hit New Highs

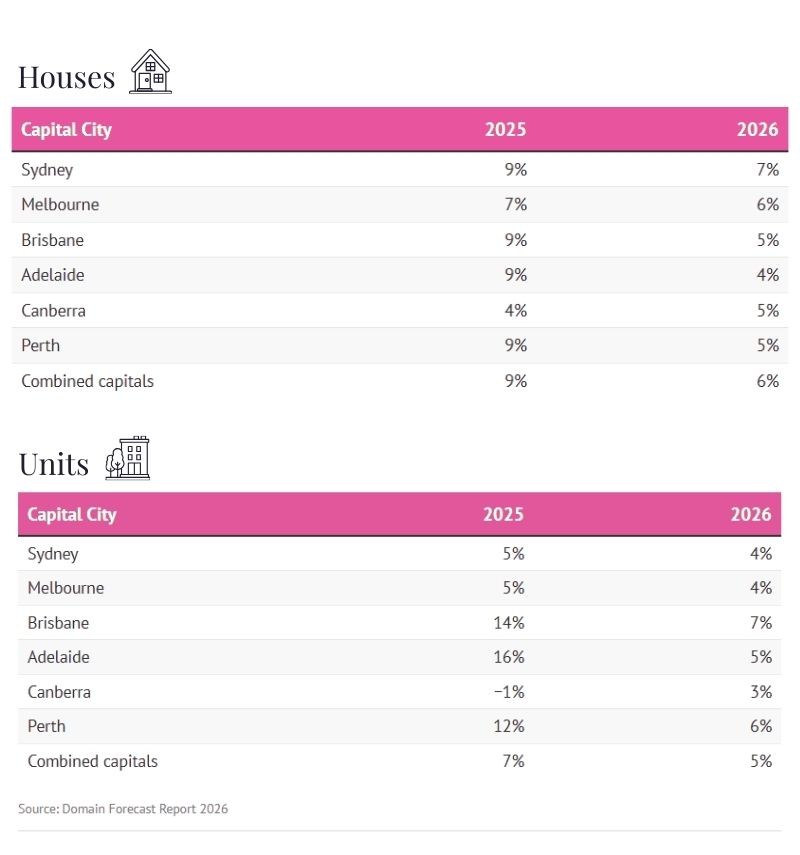

Domain’s 2026 Forecast Report projects Melbourne’s median house price to rise 6% next year, reaching an estimated $1,170,168. Unit prices are also expected to lift, with Melbourne apartments tipped for 4% growth in 2026, contributing to a full market recovery after several flat years.

Dr Nicola Powell, Domain’s Chief of Research and Economics, notes that Sydney and Melbourne are set to lead national house price growth in 2026 due to their heightened sensitivity to interest rate changes.

“We are forecasting Melbourne to be fully recovered in house and unit prices by the end of next year.”

For sellers considering timing, 2025–2026 could prove to be a strategically favourable period as buyer confidence strengthens.

(Domain’s 2026 property price forecasts)

Why Prices Are Rising: The Forces Behind the Surge

A combination of economic and policy factors is set to drive demand higher:

1. Lower Interest Rates (and More on the Horizon)

While experts expect rate cuts to be more moderate than previously thought, the next easing cycle still boosts borrowing power — especially in rate-sensitive markets like Melbourne.

2. Expanded 5% Deposit Scheme

The Australian Government’s increased support for first-home buyers is expected to bring thousands of additional entrants into the market, amplifying competition in both established and outer-suburban areas.

3. Rising Household Incomes

Improved wage growth is contributing to stronger purchasing capacity nationwide.

4. National Undersupply

Even with construction pipelines improving, demand continues to outpace available stock — particularly in Melbourne’s inner and middle rings.

ANZ, NAB, CBA, and Westpac’s projections all broadly match Domain’s outlook, with forecasts ranging from 4% to 9% growth across the capitals in 2026.

What This Means for Melbourne Rental Providers

The rental market is also expected to tighten further, with rents hitting fresh highs by the end of 2026.

• Melbourne house rents forecast to rise 2%, reaching $595/week

• Melbourne unit rents forecast to rise 3%, reaching $597/week

Demand remains intense, partly due to a lack of government services supporting temporary migrants. With 98%+ of temporary migrants renting privately, competition is expected to remain elevated, especially in inner-city and high-amenity suburbs.

For landlords, this environment supports steady rental income, strong occupancy, and ongoing rental growth.

Domain’s 2026 advertised rent forecasts

What This Means for Sellers

If you’re considering a sale in the next 12 months, you’re entering a market with:

• improving buyer confidence

• rising borrowing capacities

• undersupply relative to demand

• Melbourne returning to full price recovery

Many owners who waited through the past three years of flat conditions may find 2025–2026 to be an ideal time to re-enter the market.

The Shape Perspective

At Shape, we’re seeing this shift firsthand: more enquiry, more competition at opens, and stronger outcomes across both sales and leasing.

Whether you’re planning to sell, lease, or simply want clarity on how these forecasts affect your property, our team is here to guide you.

If you’d like a complimentary, data-driven appraisal or a chat about what 2026 may mean for your asset, we’re always here to help.